Introduction:

In the realm of financial transactions, declined payments can be a frustrating and inconvenient experience. Among the most perplexing of these is the “Do Not Honor” error. When you encounter this elusive message, it can leave you wondering what went wrong and how to rectify the situation. In this comprehensive guide, we will delve deep into the causes of “Do Not Honor” errors, explore proven solutions, and equip you with actionable tips to ensure your transactions go through smoothly.

Image: www.youtube.com

Understanding “Do Not Honor” Errors:

A “Do Not Honor” error occurs when a card issuer declines an authorization request initiated by a merchant. This rejection can arise for various reasons, but the most common ones include insufficient funds, incorrect card information, suspicious activity, frozen accounts, or daily transaction limits exceeded.

Addressing Insufficient Funds:

One of the most straightforward causes of “Do Not Honor” errors is insufficient funds in your account. Before attempting any transactions, verify your available balance to ensure it covers the purchase amount. If your balance is indeed too low, replenish it promptly to avoid any further payment issues.

Ensuring Correct Card Information:

Meticulously check the accuracy of your card information when making payments. Minor errors, such as transposed digits or incorrect expiration dates, can lead to “Do Not Honor” errors. Double-check all the details to eliminate any discrepancies and ensure a seamless transaction.

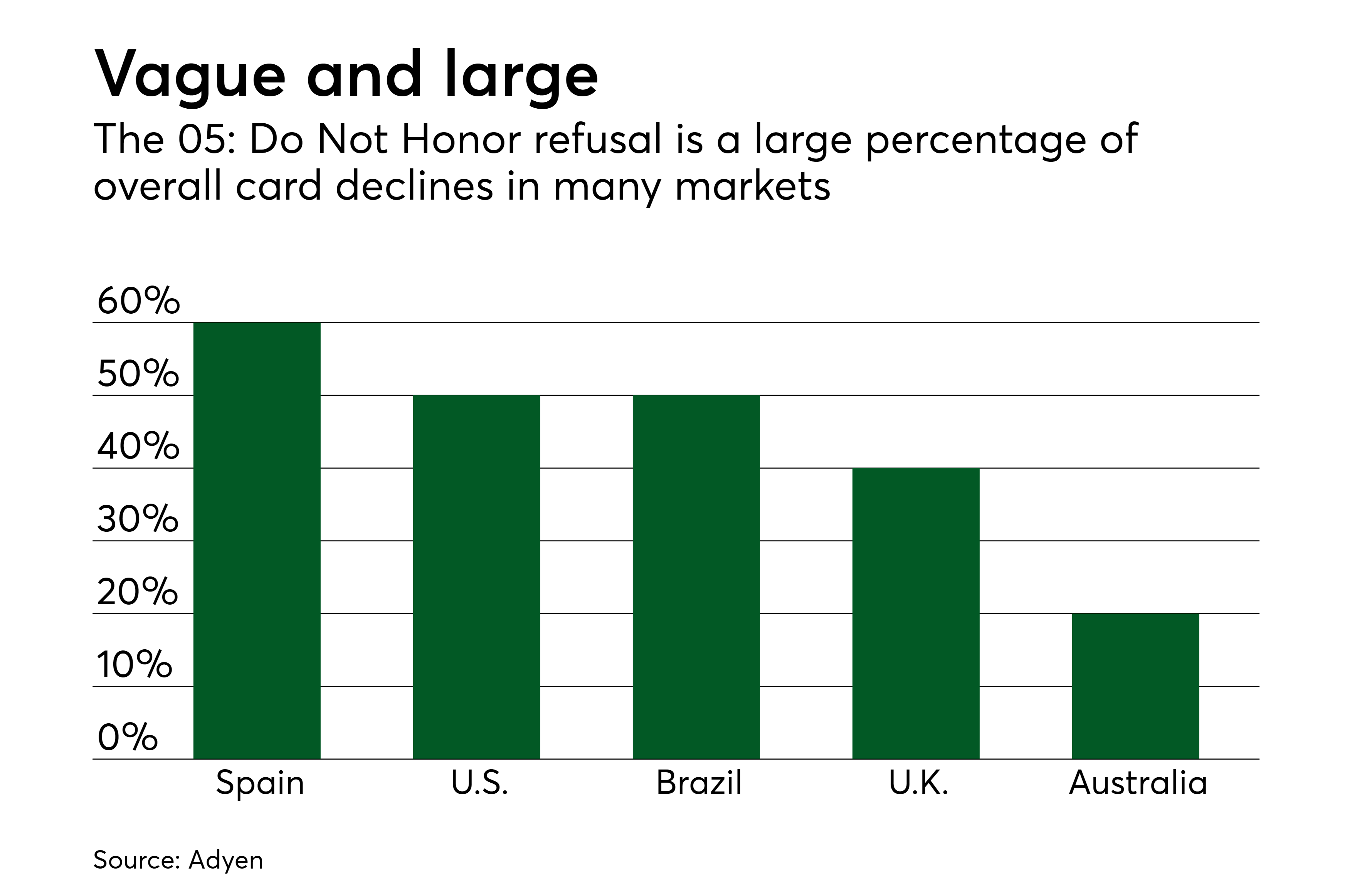

Image: www.paymentssource.com

Addressing Suspicious Activity:

Financial institutions constantly monitor transactions to detect potentially fraudulent activities. If a transaction raises red flags, the card issuer may decline it and report it as a “Do Not Honor” error. To avoid these, stay vigilant against phishing attempts, avoid entering sensitive information on unsecured websites, and keep your card details private.

Unfreezing Frozen Accounts:

In some cases, “Do Not Honor” errors may indicate a frozen account. This can occur due to security breaches, suspicious activities, or court orders. Contact your financial institution promptly to ascertain the reason for the freeze and initiate the necessary steps to reactivate your account.

Exceeding Daily Transaction Limits:

Many financial institutions set daily transaction limits to safeguard against excessive spending. If your purchases exceed these limits, you may encounter “Do Not Honor” errors. Be mindful of your daily limits and plan your transactions accordingly to stay within the permitted range.

Other Considerations:

In addition to the common causes mentioned above, “Do Not Honor” errors can also arise from technical issues with payment systems or merchant errors. If you suspect an error on the merchant’s end, contact them directly to resolve the issue. Moreover, keep your financial institution informed of any discrepancies to ensure prompt assistance.

Expert Insights and Actionable Tips:

To provide you with the most up-to-date and reliable information, we sought insights from industry experts. They emphasized the importance of monitoring your account statements regularly to detect any unusual activities or unauthorized transactions. They also advised setting up text alerts to receive real-time notifications about your account activity, enabling you to respond swiftly to any potential issues.

As a precautionary measure, consider creating a PIN for your card, enhancing its security and reducing the risk of unauthorized transactions. If you encounter a “Do Not Honor” error while making an in-store purchase, use a different payment method, such as cash or another credit card, as an alternative until the issue is resolved.

How To Fix Do Not Honor

Conclusion:

Understanding the causes and solutions for “Do Not Honor” errors will empower you to navigate financial transactions with confidence and efficiency. By following the actionable tips outlined in this guide and seeking professional assistance when needed, you can effectively resolve these issues and ensure the smooth flow of your payments. Remember, financial literacy is key to managing your finances effectively and avoiding unnecessary setbacks.